Investment Commentary Q2 – 2023 – Banging The Drum

Q2 2023 – Commentary

Over the last few years we have been reiterating our thoughts that one could outperform the stock market over time and yet take a fraction of risk in doing so. We will continue on this theme until it is no longer the case. The market continues to surprise on the upside, remains overvalued and is very thin, in that there are seven stocks in the S&P 500 which have produced 73% of this year’s return.

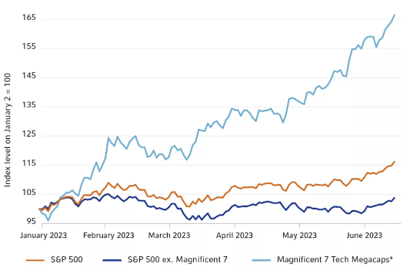

Tech Mega-Cap Stocks have Dominated US Market Returns

A small group of mega-cap stocks (Apple, Microsoft, Alphabet, Amazon, Nvidia and Tesla) are responsible for the vast majority of the market’s positive performance year to date in 2023.

There is a cohort of investors, primarily under the age of 45, who believes that they are investing in the stock market, but all they are really doing is gambling. Their investment history spans the longest bull market in history with a few hiccups being COVID and the short-lived bear market of 2022.

Today there are numerous reasons why another market correction is due. We have experienced the largest and steepest increase in interest rates in history to fight inflation. It looks like the battle is being won, but we’re not sure about the war as of yet. The consequences have yet to be felt and it normally takes at least a year for that to take place. We’ve been distracted by the emergence of artificial intelligence in a forever changing world which will bring about dramatic change, some good and yes, some bad. We live in exciting times but there are also new stresses on most people around the world living with higher interest rates. Debt levels on an individual and country level remain very high, this includes people who have borrowed money to invest in stocks.

As a firm, at Our Family Office, we are asset allocators. We work with our families on a complete Asset Architecture™ and how the money that we manage and allocate for them fits into their total wealth picture. A liquid portfolio may make up only a fraction of total net worth, which includes real estate investments, family businesses, residential real estate, wine collections, art and other assets.

When we allocate to different asset classes, we focus on risk (volatility as measured by standard deviation). The risk of each asset class can be quantified by this volatility number. Some have data going back 100 years like stocks and bonds. We have found many other asset classes outside of stocks and bonds that will produce a much better return for a fraction of the risk.

When most people think of assets, and remembering your grade 7 grammar, they think of assets as nouns. Real estate, bonds, private, equity, etc. We like to think of them as verbs: what do you have in your portfolio that will mitigate risk, enhance your returns, stabilize your portfolio and protect against inflation?

It’s interesting to look back with humility at the world pre-COVID and then post-COVID when interest rates were zero and real rates were negative. One would think that when interest rates were zero, and one day they would move, the only direction that could be is up. It did not take a genius to understand that.

A few years ago we made a tactical decision that any asset class that produces income be it mortgages, secured lending strategies or even bonds were floating rate and very short duration. We made this decision because we felt we could take less risk and earn more return when interest rates went up. It has proved to be correct in that mortgage funds and lending strategies that gave us 6.5% in 2021 was 7.5% last year and hopefully this year will give us north of 8.5%.

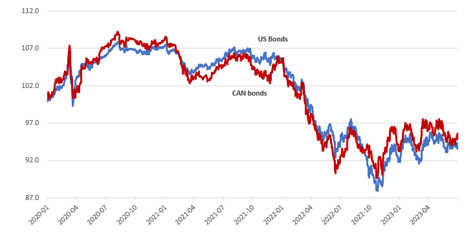

The very short duration bond strategies we used protected capital during last year’s severe drawdown (down just 3% relative to the global bond index being down 16%). This enabled our clients to maintain their wealth in a year when the popular 60/40 model of stocks and bonds was down some 16%. We will maintain this strategy until interest rates start going down over the next year or so.

I’m not sure I’m a person who likes surprises and in the context of the investment world if there was a surprise, I would posit that it would be a negative one. At this time I believe that there is a lot more in the world that can go wrong than can go right. It feels to me a little like the calm before the storm. especially when you look at stock market volatility. This remains a time to be a disciplined investor that understands there are many more asset classes out there, other than stocks and bonds, where you can earn a greater return for much less risk.

With the high level of uncertainty that remains on the path forward there are bound to be unanticipated surprises on the horizon. This is why we emphasize non-predictive decision making as opposed to forecasting specific events. This requires a disciplined investment process and appropriate diversification that builds resilient portfolios. Even though this can be a “boring approach” as we never chase the markets out of “FOMO” (fear of missing out), we simply serve very wonderful families with high expectations. When the market is up, they expect us to be up and when the market is down, they expect us to be up. That worked very well for us last year.

Q2 2023 – The Markets

Equity markets continued to deliver strong returns in Q2 as investor optimism over slowing inflation and a potential pause in global monetary tightening boosted the appetite for riskier assets.

US stocks posted a very strong Q2 with the S&P 500 up 8.7% (+16.9% YTD). Results were somewhat muted to start the quarter with concerns over another debt ceiling standoff weighing on the market, but after Congressional approval assuaged that fear a strong June defined the quarter. The information technology sector, which is well represented in the US market, drove those returns as bullish sentiment around disruptive new AI technology drove up tech stocks and chipmakers in particular.

An interesting note regarding the year-to-date returns of the S&P 500 is that roughly 73% of the gains this year have come from just seven mega-cap stocks known as the “Magnificent Seven” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla and Meta). This shows a serious lack of breadth in the market strength we have seen so far in 2023. The market has performed well if you look at just the top level number, but that does not paint the whole picture as many companies in the index are roughly flat or even down on the year. A salient reminder that the market recovery we are witnessing is not necessarily evidence of a wider economic rebound.

Canadian stocks posted a small gain in Q2 with the TSX 60 up 1.6% (+5.7% YTD). The leading factor as to why the Canadian market has lagged its US counterpart this year is due to the fact that there is much less exposure to the tech sector North of the border. The companies akin to the “Magnificent Seven” that are driving returns in the US are not a significant component of the TSX. Additionally, recent weakness in oil prices is a headwind for the resource heavy Canadian market.

Developed international equities, as represented by the MSCI EAFE Index posted a Q2 return of 3.0% (+11.7% YTD). The UK (+2.2% in Q2) and Eurozone (+3.2% in Q2) were relatively muted in the quarter as the UK continues to battle stubborn inflation while Europe’s stagnant GDP growth is teetering on recession. On the other hand, Japan has been one of the stronger constituents (+6.4% in Q2) on the back of increasing domestic spending and lower oil prices (which benefit the island nation as a net importer).

The Emerging Markets as a whole have underperformed the developed world in 2023. The MSCI Emerging Markets Index produced a relatively flat Q2 return of 0.9% (+4.9% YTD). China makes up nearly one third of the index and is fundamental to EM returns.

Q2 2023 – The Markets

The Chinese economy has not yet picked up in line with its post-COVID reopening, households in the country have increased savings but domestic consumption has yet to recover. The Chinese consumer and potential accommodative policies from the government will be major keys to watch going forward.

Equity investors, after suffering through a painful 2022, may be eager to buy into this recent market optimism with the hope of capturing quick returns. However, as we have covered in previous writings on the other “R” word, we believe it is always prudent to consider not just returns but also the risk being taken in pursuit of them.

The full impacts of aggressive central bank tightening may not yet have been felt, there is potential recession on the horizon and economic indicators on manufacturing and bank lending standards are signaling weakness.

It is possible that markets continue to climb from here, perhaps on a wave of artificial intelligence innovations. However, we think investors should continue to place their focus on potential risk rather than fear of missing out on returns.

In fact, if you look in the right asset classes, there are very good returns to be had for a fraction of the risk and uncertainty you would have to take in the stock market.

Q2 2023 – Interest Rates and Inflation

Central bank actions have been a major theme for the past year as markets digested the fastest rate hikes in recent history. With the exception of the Bank of Japan, all major central banks continued to raise interest rates through the second quarter.

The Fed raised 25 bps in May before electing to pause in June, following the quarter they have raised an additional 25 bps in July bringing the Fed funds rate to 5.5% currently. Similarly, the Bank of Canada raised 25 bps in June following up with another 25 bps increase in July to bring the overnight rate to 5.0%. The European Central Bank raised twice in the quarter to bring their main refinancing rate to 4%. The UK has seen stickier inflation than other countries, leading the Bank of England to raise twice in the quarter including a larger than expected 50 bps increase in June, bringing the policy rate to 5%.

Investors expect that many nations may now be nearing the much anticipated pause in interest rate increases. The full impact of rate increases can take 18-24 months and with inflation beginning to moderate central bankers will be watching closely over the next several quarters to see if their policy decisions over the past year have done enough to bring inflation back into line.

Inflation has moved in the right direction so far in 2023. Headline inflation in the US slowed to 3.0% on a year over year basis primarily due to a decline in energy prices as crude oil fell from $105 per barrel at this point last year to $70 per barrel through June.

However, services inflation has remained persistent, looking at the core inflation metric (which excludes the more volatile energy and food segments) the US is still reading 4.8% year over year inflation through June. Canada has seen a similar trend with headline inflation down to 2.8% in June while core inflation remains elevated at 3.2%.

This interplay between inflation, rates and looming recession is the relationship to watch over the next several quarters. Higher rates appear to be having the desired impact on inflation but this raises additional questions. How long will rates remain at these levels, especially in a scenario where core inflation remains sticky above 3%? As the economy begins to feel the longer-term effects of tightening what level of growth contraction will we see? If we enter a recession in the near future will central banks be able to respond with accommodative policy if inflation is still above target?

These are all risk factors that we can’t know the answers to but will play out over the next several quarters and years. As investors we can make bets on potential outcomes, which may turn out to be right or wrong, or we can build portfolios with asset allocations that perform regardless of what the future holds. Especially in times of heightened risk and uncertainty we believe strongly that the latter approach is preferable from a risk return and capital protection standpoint.

Q2 – 2023 – Charts

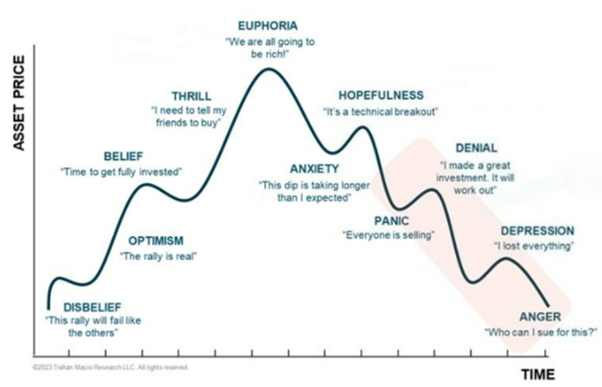

- Investors naturally exhibit various emotions throughout the market cycle which translate into biases with respect to managing their assets. It is easy to act impulsively, buying or selling certain assets at inopportune times without being mindful of the bigger picture.

- Before taking investment action, it is imperative to ascertain whether observed moves in markets are sustainable and driven by a change in underlying economics, or whether they are purely speculative or temporary. Doing so can make all the difference in achieving one’s financial goals.

- It is a useful exercise to ask ourselves where we feel we are in the above cycle prior to making investment decisions.

The Average Holding Period for Stocks has Fallen

- The average holding period for stocks has dropped dramatically over the past decades.

- The emergence of high frequency trading has played a large role in this trend.

- Technological improvements that now allow retail investors to trade in and out of positions seamlessly from their computers and phones (and for very little cost) is also a factor.

- The yield, which is a measure of expected returns is depicted in the above chart for three asset classes with very different risk profiles.

- What is particularly striking is that the yields have converged, which makes owning equities a tougher sell when compared to bonds (lower risk) and cash (least risk).

- The recent run-up in equities driven by technology stocks coupled with weakness in bonds and high overnight interest rates (controlled by central banks) benefitting cash products, have resulted in this unique circumstance.

Chart 1: Ten Year U.S. Treasury Yield (%)

Table 1: Commodities (USD)

Chart 2: Cdn & U.S. Bond Market Performance

Table 2: Summary of Global Equity Returns

Download a copy of this article in pdf here.

Insights

View AllNews & Events

News & Events

Keep up to date on Our Family Office's latest firm news, events, global and regional awards, as well as the latest announcements.

Tim Cestnick’s Globe & Mail Articles

Tim Cestnick's Globe & Mail Articles

Catch up on our Co-Founder and CEO, Tim Cestnick's weekly column. His status as an expert is reinforced by his role as a tax and personal finance columnist for The Globe and Mail, Canada’s most prominent national newspaper.

Investment Thinking

Investment Management

We provide tax-efficient preservation and growth of your investment assets, utilizing best-in-class global strategies, strategic asset allocation, rigorous due diligence on managers and their selection.

Podcasts

Podcasts

Our Family Office proudly presents the Our Family Office Podcast. Throughout the inaugural season, host Adam Fisch speaks to various experts from across our firm, offering insights into the areas of focus for an integrated family office, and the ways that a Shared Family Office™ can help Canada’s wealthiest families.