Investment Commentary Q1 – 2024 The Lessons of History

Q1 2024 – Commentary

As I write our quarterly commentary’s first section, I try to share a philosophy and process that underscores how we invest our client families’ liquidity. Over the last several years we’ve been very consistent with a point of view that has not really changed. We are risk adverse and can earn a better return for fraction of the risk of a stock and bond portfolio.

I want to start this quarterly commentary with the expression… “once upon a time in a far away land called the stock market”. Having been in the investment industry for over half a century, I have never seen what I’m witnessing now. In the past, people used to take their savings and invest their funds for the long-term, waiting patiently for their investment portfolio to grow. They were taking their appropriate amount of risk for a mid to high single digit return, which historically has been the stock market’s return over the last hundred years.

As I’ve stated many times in the past in these commentaries, I’ve never seen the world so upside down. You would never expect someone to take their life savings and feed them into a slot machine with the hope of hitting a jackpot. In a past commentary, I mentioned all the new words in my vocabulary that were not present some 10 years ago…words like de-globalization, de-dollarization, meme stocks, politicization, polarization, woke etc. In the last month I found a new term that I want to share with you and it’s quite bothersome to me.

I don’t know if you’ve ever heard of the term “financial nihilism.” It was an expression coined in 2021 by Dimitri Kofinas, an entrepreneur and host of a media and technology education platform. The term is now being used widely, especially in social media. So what does it mean? Financial nihilism basically means making reckless investments or gambling by people who think that life is stacked up against them. If we think about it, there is a generation of young people in Canada and elsewhere around the world that don’t think they’ll ever be able to afford a home. They have lost trust and admiration for our institutions that were important to us and our parents, like government, churches or synagogues and universities. They don’t believe that they will ever earn enough money to live their parents’ lifestyle or live in a house like the one they grew up in, and in some ways, the numbers justify that belief. The average price of a home for baby boomers and Gen Xers was 4 1/2 times their average salary. Today for someone under 30, Gen Y, a starter home is 7 1/2 times their salary. Baby boomers when they were 25 owned 33% of the homes in America, but today’s 25-year-olds, only own 13%.

Because they believe that they’ll never have enough money and have lost faith and hope they are taking, in my opinion, excessive risks in the way they are investing. They are gambling, whether it be on who scores the next goal or the spread of a basketball game. With the proliferation of sports betting, they are risking losing it all.

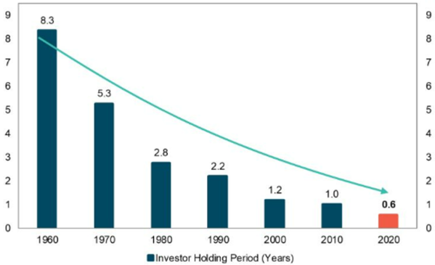

In a recent conversation with a client on the subject of gambling, he reminded me what the purchase of lottery tickets really were. He said “they are a tax on the stupid” and I agree very much with this. We’re not talking about buying one five dollar ticket to win $50 million, we’re talking about those people spending hundreds of dollars every week with money that they could ill afford to lose. We’ve showed this chart before, but I think it’s important to understand how investing used to be a long-term researched and profitable pursuit. Today, stock trading is more like sports gambling, where the risk is increased in a market that is priced for perfection.

The Average Holding Period for Stocks has Fallen

My investment philosophy is very much like my gambling philosophy in that I hate to lose much more than I like to win. I know that gambling is not a good thing. It’s addictive and it’s a losers game. The casino always wins. That’s not to say you can’t get lucky from time to time, but that is not investing, certainly not the way Sir John Templeton taught me. Sir John and I used to have some lively debates and he loved to remind me that it’s not how much you make, it’s all about not losing. He was always interested in buying stocks when he felt they were bargains, being a contrarian when everyone was selling as the markets panicked. He sold stocks when he felt they were overly valued, but more importantly when he found something of much better value to invest in.

We run our all-weather portfolios very similarly to the portfolio manager that everyone reading this has in common: CPPIB, our Canada Pension Plan. They are 65% in asset classes other than a stock or bond and they are investing some $600 billion for us Canadians. We have found a way of democratizing this approach, where we can take very little risk for high single digit returns in the future. Why shouldn’t your money be managed as if you had $600 billion?

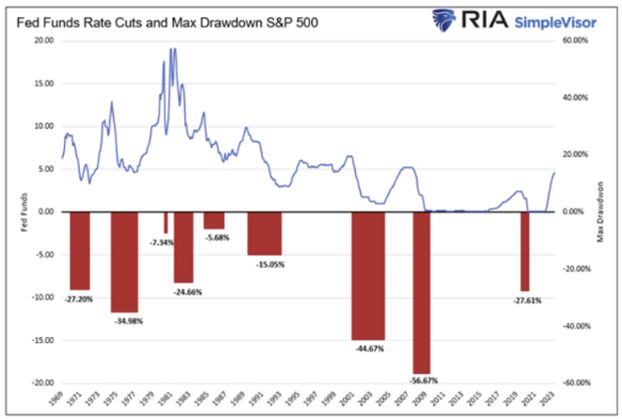

Today there are many asset classes that deserve people’s attention because they’re much better value on a risk/return basis than equities. Historically, every time interest rates go down – and we expect them to start going down sometime this year – the stock market goes down because interest rates have to come down for a reason (see chart on page 8).

There are a number of political risks in the world today, including half of the world’s population voting this year and a number of regional wars, and those are the risks we know about. What we don’t know are the unknown risks. These conditions amount to a stock market with very little room for error.

We do believe there will be an opportunity to buy stocks and add to our equity holdings in the future. In the meantime, we are very happy with the returns that we are achieving in many different strategies for our families.

When the pandemic hit four years ago and governments brought down interest rates to almost zero, we decided that in the future, they could only move in one direction. We made a tactical decision that any income strategy we had would be very short duration and floating rate. We did that so we could take advantage of interest rates going up and limit downside on our bonds, which always move in an opposite direction to interest rates.

That strategy worked very well for us since, and especially in 2022 when the popular 60/40 model of stocks and bonds was down some 16%. Our All-Weather Portfolio was up that year with a fraction of the volatility of the 60/40 model.

We recently made another tactical decision investing a lot of cash into floating rate and short duration mortgages which we always had and have performed very well.

We increased our allocation to this asset class because the 4.8% we currently get on daily liquidity cash is half of what we’re getting on mortgages, but 2-3 years from now, we may only be getting 2% in cash, but our mortgages over the next few years should return over 8%. We’d be getting four times our return on cash with very little increase in risk.

There’s another lesson in history going back thousands of years. When looking at countries and empires who dominated for centuries it is scary to observe how it ended for them. One of the reasons of course is war. France and Napoleon’s dominance in Europe ended with the War of 1812. We have also seen that since beginning of the 20th century, with the collapse of Germany on two occasions and Japan as well at the end of Second World War.

Internally empires fall through revolution and civil war. Examples of that would be the Russia Revolution of 1917 and of course, the American Revolution which established the United States in 1776. The causes of those two events seem to be a very large divide between the rich and the poor and also the extreme polarization between the far right and the far left. With what is going on in the world today and particularly in the United States, perhaps the seeds have been sown for the peaking of America. I for one certainly hope not.

We are living in historic times.

Q1 2024 – The Markets

The first quarter of 2024 was marked by continued strength for global equities, with several markets reaching all-time highs, driven by growing hopes for a soft economic landing, along with ongoing optimism around Artificial Intelligence (“AI”). The S&P 500 posted +10.6% for the quarter. The major drivers were the familiar AI family of stocks, led by Nvidia and Microsoft. 10 of the 11 sectors were positive, with only the Real Estate sector declining as interest rates rose higher.

The equal-weighted S&P 500 was up a smaller +7.9%, and the small-cap Russell 2000 was only up +5.2%, illustrating the continued narrow nature of the rally.

While some European equity indices reached new all-time highs, European equities overall continued to lag the US and Japan. Emerging market equities underperformed their developed market peers, with the MSCI EM Index returning 2.4% as investors remained concerned about China’s growth prospects in the absence of any meaningful fiscal stimulus. The MSCI China Index, nevertheless, rebounded 12.3% from its January low on the back of better economic activity data during the Lunar New Year holiday and some easing measures from the People’s Bank of China.

While equity investors cheered strong economic data, for bonds investors it was a more challenging period. Stickier inflation prints, resilient economic activity, and the Federal Reserve (Fed) backpedaling somewhat on its dovish tone combined to drive interest rates higher . Overall, US treasury yields rose across the curve, with the 10-year treasury yield rising from 3.88% to end the quarter at 4.20%, leading to a negative quarter for bonds.

At the center of the Wall Street’s collective attention was the Fed. At the very start of the year, markets were expecting six rate cuts by the US Federal Reserve (Fed) over the course of 2024. Economic data was broadly positive, which saw expectations of a recession in the US fall. However, inflation data came in higher than expected in the first quarter, which prompted the Federal Reserve to caution against cutting rates.

Minutes released from the Fed’s January meeting showed that most of its members thought moving too quickly to cut rates carried a bigger risk (of prompting an overheated economy) than keeping policy tighter for longer. As it stands, the market is currently expecting two 25 basis point cuts in 2024, down from six at the turn of the year.

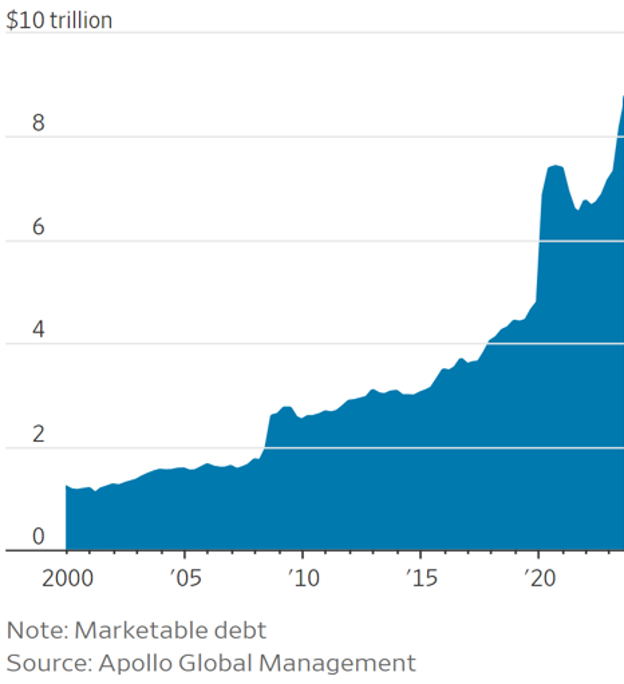

The U.S. government funds its operations by selling Treasury bonds to investors and dealers at regular auctions. Issuance of Treasury bonds has exploded since the pandemic began. A record $8.9 trillion of Treasury bonds, roughly a third of outstanding U.S. debt, is set to mature just in 2024.

Investors showed tepid interest for new issuance of Treasury bonds in auctions in the past several weeks. Coupled with sticky inflation, the influx of new issuance of Treasury bonds could add more pressure to rates, keeping rates higher for longer.

The vast majority of the recent rise in stock prices over the past several quarters is attributable to valuation multiple expansion (reflecting growing investor optimism), not profit increase. That multiple expansion was largely attributed to expectations that inflation would quickly fall back to the 2% target level, leading to central banks cutting interest rates and successfully engineering the dream soft-landing scenario. As we have seen with expectations versus reality as it relates to rate cuts, it turns out that attempting to make accurate predictions of the future is a gamble that often does not pay off.

We remain cautious and continue to manage portfolios in a prudent manner with a long time horizon for the future generations of your families.

U.S. Public Debt Maturing Within The Next Year

Q1 – 2024 – Charts

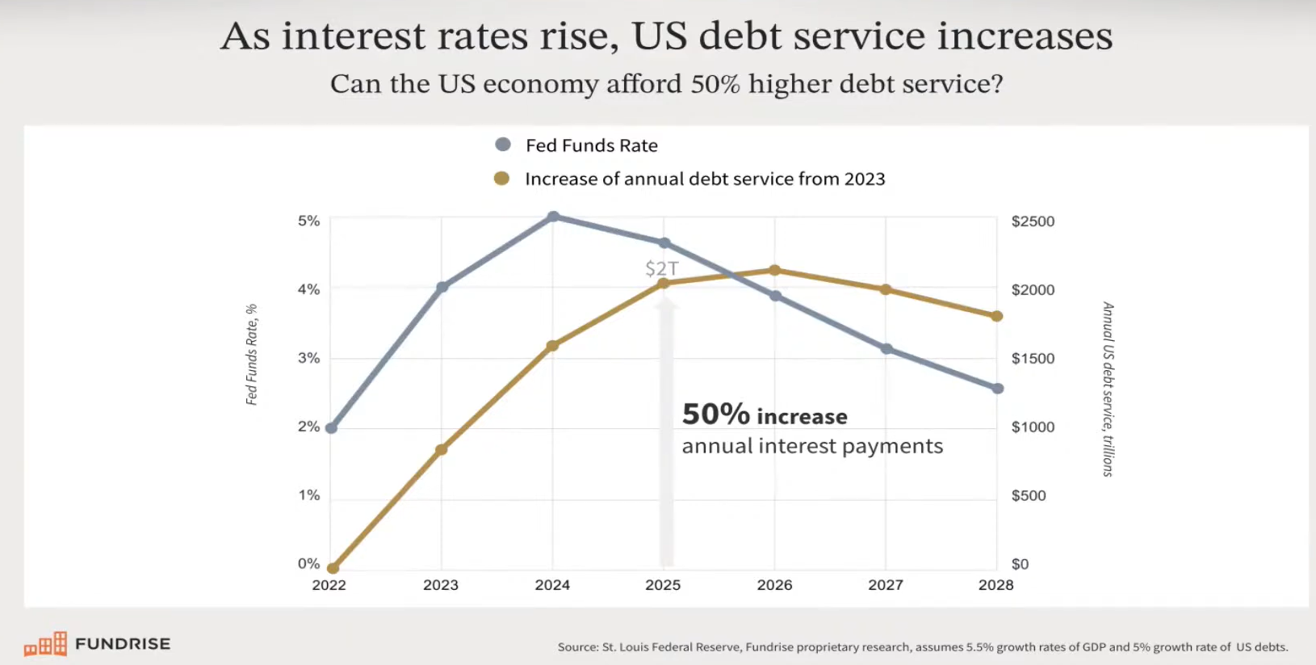

- The above chart shows a history of and expectations for the Fed Funds rate along with annual US debt service payments.

- Even if rates come down in line with current expectations the debt service cost will continue to increase through 2026 as older lower rate debt comes due.

- If rates stay higher for longer than expected the impact on debt service could be meaningfully worse than depicted above.

- The above chart shows a history of the Fed Funds rate (top) along with maximum drawdowns in the S&P 500 index (bottom).

- Large drawdowns in the S&P 500 index often coincide with falling interest rates.

- Although lower rates may be bullish for equities over a longer horizon, a crisis and market panic is often the initial catalyst for central banks to begin dropping rates aggressively.

Download a copy of this article in pdf here.

Insights

View AllNews & Events

News & Events

Keep up to date on Our Family Office's latest firm news, events, global and regional awards, as well as the latest announcements.

Tim Cestnick’s Globe & Mail Articles

Tim Cestnick's Globe & Mail Articles

Catch up on our Co-Founder and CEO, Tim Cestnick's weekly column. His status as an expert is reinforced by his role as a tax and personal finance columnist for The Globe and Mail, Canada’s most prominent national newspaper.

Investment Thinking

Investment Management

We provide tax-efficient preservation and growth of your investment assets, utilizing best-in-class global strategies, strategic asset allocation, rigorous due diligence on managers and their selection.

Podcasts

Podcasts

Our Family Office proudly presents the Our Family Office Podcast. Throughout the inaugural season, host Adam Fisch speaks to various experts from across our firm, offering insights into the areas of focus for an integrated family office, and the ways that a Shared Family Office™ can help Canada’s wealthiest families.