Q3 2022 Investment Commentary

Investment Commentary Q3 – 2022

Uncertainty and Opportunity

Q3 2022 – Commentary

If investors were hoping for a quick quarter to quarter bounce back in their portfolios they came away sorely disappointed after continued drawdowns in both stocks and bonds in Q3. Clearly a “V” recovery, with a rapid drawdown and equally rapid recovery, similar to what transpired at the onset of COVID in the first half of 2020, is not in the cards.

That is not surprising as just over 2 years later the situation is vastly different. Inflation leading up to 2020 was stable at reasonable levels (between 2-3%) dipping below the 2% target level during the pandemic. With inflation low central banks were able to use all the tools at their disposal (including lower interest rates) to stimulate the economy and fuel a quick recovery in markets.

Contrast that to our current situation of elevated inflation (U.S. inflation at 8.2% as of September) that has turned out to be much less transitory than many had hoped. The Fed mandate is to get inflation under control and the rate increases which have been employed to accomplish that goal have led to large losses and volatility for stocks and bonds.

The Fed’s Jerome Powell said that fighting inflation would “bring some pain” and investors in the traditional asset classes of stocks and bonds have surely felt pain this year. One of the most common allocations for traditional investors, the 60/40 (60% stock 40% bond) portfolio is down over 20% year to date through September.

When can traditional investors expect a dovish fed pivot and a turnaround in their returns? No one knows the answer to that question with certainty. What we do know is that central banks will likely need to see inflation start to moderate before they can change their hawkish stance.

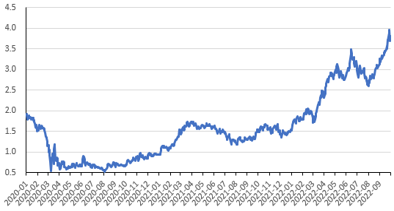

US Y/Y Inflation Rate

Even if inflation recedes and allows central banks to tone down their policy there is still a recession to overcome. While stock valuations have come down substantially we have yet to see a significant decline in earnings.

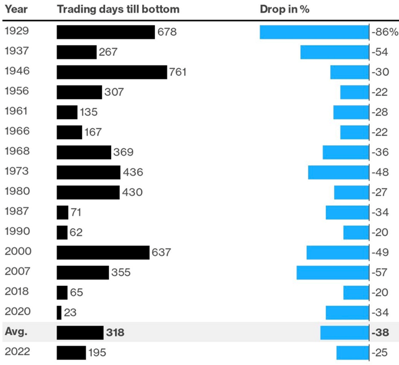

Over the next several quarters we will be watching closely to see how the combination of inflation and restrictive central bank policy begins to filter down through the real economy, and ultimately to corporate earnings. If earnings fall considerably and inflation remains high the market could be in for another painful leg down. In fact, looking at the average length of time and percentage decline in the S&P 500 during previous bear markets we are still below average by both metrics.

There are many market news headlines exclaiming “Investors have had nowhere to hide”. We would argue that is not exactly true, or perhaps these titles should specify that it is investors in traditional asset classes that have had nowhere to hide.

Despite all the red in stocks and bonds there are many non-traditional investments, which have low or no correlation to the market, that are positive for the year (private mortgages, diversified lending, private equity). Having a significant allocation to these non-traditional investments, which pension funds and institutional investors have been including in their portfolios for some time, can generate great returns and protect capital in volatile market environments. Asset allocation is the main driver of returns, and that has never been more apparent as a traditional asset allocation (60/40 portfolio) is down over 20% in 2022 while those portfolios that include non-traditional investments, such as the All-Weather portfolios we manage for our clients, range from being down low single digits to being positive for the year.

S&P 500 Bear Market Declines

Q3 2022 – The Markets

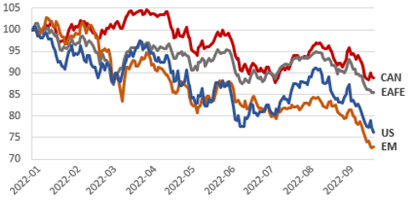

Market performance has been subdued this quarter once again, driven by sticky inflation prints, rising bond yields and concerns over slowing growth. There seem still to be very few places to hide in the public markets.

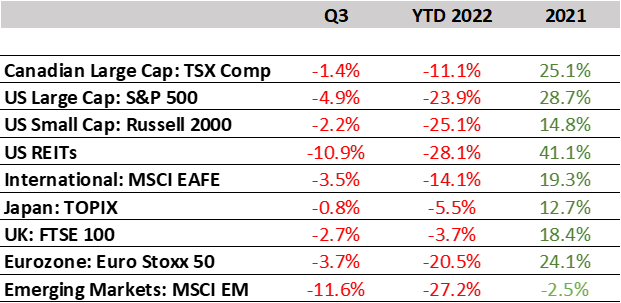

North American equities, after rallying early in the quarter, continued to move down with both the S&P 500 and TSX breaching their recent lows. The snapback in equities renewed concerns that markets have more room to fall and that the summer rally was just another counter trend amidst a bear market – there are on average six counterrallies in every bear market historically.

The S&P 500, after being up nearly 10% in the quarter by mid-August, ended down 4.9% for Q3 (-23.87% YTD). North of the border the TSX, after being up nearly 6% in the quarter, ended down 1.4% for Q3 (-11.14% YTD).

Eurozone equities felt the pain of an energy crisis by way of a looming winter gas shortage tacked on to already elevated prices, and an economy indicating an impending slowdown in economic growth. Given that risk appetite was muted, it isn’t any wonder that the MSCI EAFE index, made up of developed international markets, was down 3.59% (-14.46% YTD).

Tightening financial conditions, a strong US dollar and high inflation weighed heavily on Emerging market equities. The MSCI Emerging Markets Index was down 11.57% (-27.16% YTD).

Typical of the Emerging Market index, performance was a mixed bag. Commodity producers like Brazil, Chile and Qatar pulled performance up whereas China, the standalone gainer last quarter lagged behind most in Q3. While geopolitical tensions ignited fears of further breakdown in the global supply chain, COVID-19 lockdowns, and jitters from the property market woes weighed on Chinese equities.

Investors who held large allocations to public equities have had to endure heightened volatility and large drawdowns this year, regardless of geographic makeup. However, there is a silver lining for some, as more prudent portfolios that maintained lower equity weightings are positioned to take advantage of this market dislocation. These portfolios now have the opportunity to dollar cost average into equities as prices drop and valuations become more attractive.

YTD Equity Market Returns (Indexed to 100)

Q3 2022 – Interest Rates and Inflation

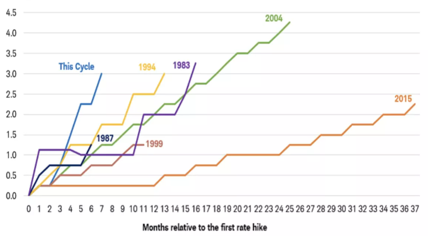

The summer bounce in equities was buoyed by hopes that the Fed would pivot to start cutting interest rates in 2023. However, central bankers at the Jackson Hole summit in August sent a clearly hawkish message that fighting inflation was still their first priority – sending stocks into a dramatic decline for the latter half of the quarter. The Fed then hiked by another 75 basis points to 3.25% after already raising rates by 75 basis points in July. This has been the fastest pace of interest rate hiking by the Federal Reserve on record and is a testament to its former complacency regarding inflation risk. The Bank of Canada also followed a similar pace by steadily and aggressively hiking the overnight target rate to 3.25% in September.

Whether inflation has peaked or not remains to be seen. Warning signs flashed by giants like Fedex and Walmart are pointing to a slowdown in the economy, as are higher than average inventories, telling signs that the Fed’s actions to cool the economy may be having an impact. These are clearly bearish indicators for the individual companies reporting them. However, the market has been interpreting such signs of slowing growth as positive signals that the Fed may pause hiking or cut rates sooner. A classic example of the strange times we are in where the market can interpret bad news as good news.

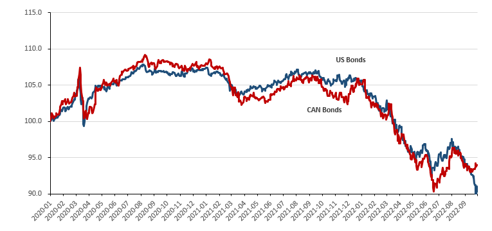

As yields rise, bond prices fall. This inverse relationship underpinned the action in fixed income markets where increasing yields (the 10-year US Treasury yield increased by 83 basis point in Q3) have led to the worst year in modern history for the asset class. The Bloomberg Global Aggregate Index posted a quarterly loss of 6.94% (-19.89% YTD).

Change in Fed Funds Rate (%)

Shorter duration bonds fared significantly better as can be seen in the quarterly performance of the BofA Merrill Lynch 1-3 Year Treasury index, which posted a relatively benign loss of 1.18% (-4.35% YTD).

Rapidly increasing rates may also present some opportunities. Investing in shorter duration and floating rate fixed income has protected capital relative to the broader index and we believe that positioning still represents a good risk return prospect today. Real estate managers who are well positioned can also benefit from motivated sellers in this higher rate environment, making prudent acquisitions as a base to start building value through development.

Q3 – 2022 – Charts

- The Wilshire 5000 Index, which is a broad-based stock index, divided by the GDP illustrates how risky the market still is relative to the last 50 years.

- This indicator of market valuation measures the market capitalization of public equities relative to Gross Domestic Product in the United States.

- When public market valuations are high relative to GDP (100%+), as they are now, that is an indication that markets are overvalued.

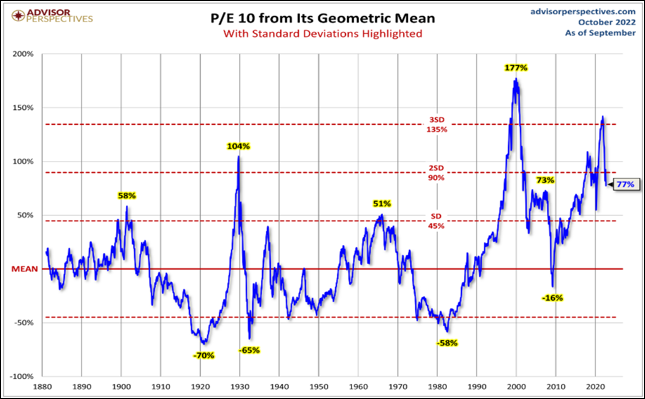

- The P/E 10 ratio divides the price of the S&P500 by a 10-year average of inflation-adjusted earnings, effectively smoothing out fluctuations in the business cycle.

- This 140-year graph showing the Price Earnings (P/E) Ratio with risk being highlighted, shows that the market is still priced rather expensively.

- When the ratio exceeds 2 standard deviations above the mean, bear markets have historically followed. As the metric recently breached the 3 standard deviation from the mean level, it is no surprise that we saw a bear market in US equities through the first half of the year.

Chart 1: Ten Year U.S. Treasury Yield (%)

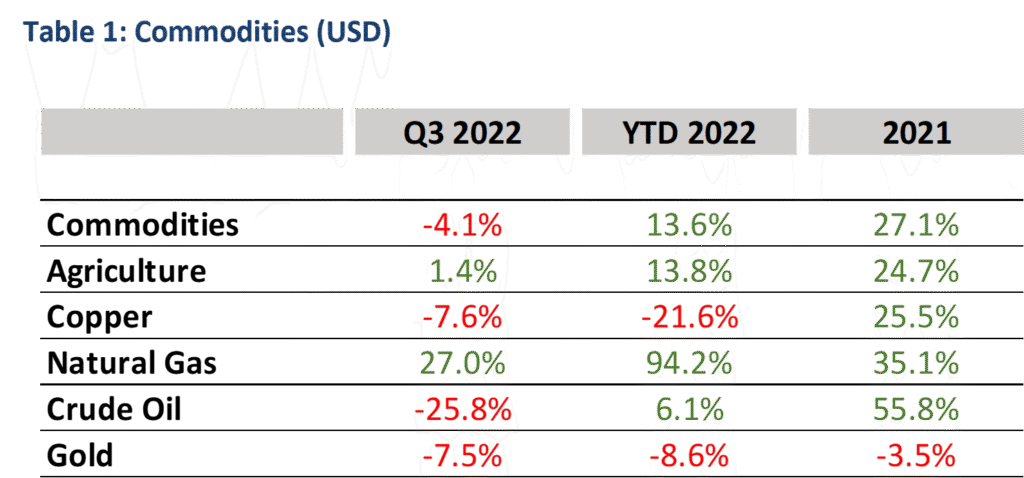

Table 1: Commodities (USD)

Chart 2: Cdn & U.S. Bond Market Performance

Table 2: Summary of Global Equity Returns

Download a copy of this article in pdf here.

Insights

View AllNews & Events

News & Events

Keep up to date on Our Family Office's latest firm news, events, global and regional awards, as well as the latest announcements.

Tim Cestnick’s Globe & Mail Articles

Tim Cestnick's Globe & Mail Articles

Catch up on our Co-Founder and CEO, Tim Cestnick's weekly column. His status as an expert is reinforced by his role as a tax and personal finance columnist for The Globe and Mail, Canada’s most prominent national newspaper.

Investment Thinking

Investment Management

We provide tax-efficient preservation and growth of your investment assets, utilizing best-in-class global strategies, strategic asset allocation, rigorous due diligence on managers and their selection.

Podcasts

Podcasts

Our Family Office proudly presents the Our Family Office Podcast. Throughout the inaugural season, host Adam Fisch speaks to various experts from across our firm, offering insights into the areas of focus for an integrated family office, and the ways that a Shared Family Office™ can help Canada’s wealthiest families.