Q3 2025 – Commentary

“Double, double toil and trouble; Fire burn, and cauldron bubble” Macbeth

Very few people under 50 have an investment memory going back 25 years. They did not live through or experience the .com bubble or the Great Financial Crisis which both occurred in the decade between 2000 and 2010. If you had, you would know that there are times when the stock market can go down more than 40% and not recover for several years. To get back to where you were before that steep decline, you must go up 66.6%. That 40% decline happened twice in that 10-year period. We’re not suggesting that it is about to happen or that it could happen again soon, but it will one day.

We have a cohort of investors, who we believe are actually gambling in the stock market. The fear of missing out and chasing returns concern us. They’re not spending time looking at company fundamentals, understanding balance sheets, and valuations, they are speculating. Meme stocks have once again become the flavour of the month. The most recent example of this was about two weeks ago in a company that we’re all familiar with called Beyond Meat (BYND). Some six years ago it went public at $25 and traded as high as $240 a share. A couple of weeks ago it was $.50. The reason I’m bringing this up is that it only took a few days for the stock to increase from $.50 to nearly $8, up some 1,540 percent and then came crashing down to $2.00 a share.

A company’s share price increases over time as their earnings grow and/or their price to earnings ratio increases. I’m not commenting on the fundamentals of this company. But the activity where mostly young people, motivated by what they read on social media, buy shares that push the stock up over 15 times in just a few days, is concerning. If this isn’t gambling or profound speculation, I don’t know what is.

The Magnificent Seven and now AI stocks have created what many describe as a bubble. Bubbles inflate, but how large a bubble grows, and if and when it finally bursts is unknown.

Financial bubbles are not new as there have been many in history going back 400 years or more. In the early 1600s it was Tulip-mania, which was considered the first speculative bubble on record. There was also the South Sea Bubble in 1720 where that company’s share price rose dramatically before collapsing. This caused a financial panic across all of Great Britain. Of course, the roaring 20s stock market bubble, where markets rose dramatically for a number of years and culminated with the crash of October 1929 shaped the mindset of a whole generation of investors. This was the major trigger to the Great Depression of the 30s.

How a person is raised by his parents and his experiences growing up determine to a very large degree his or her investment philosophy for the future. If you grew up during the depression, that had a major influence on the risk you took, and how you invested, and the quality of your personal balance sheet, i.e. did you take on margin debt to make your investments? If you grew up during a bull market, where every stock you bought went up and never had any personal experience with market downturns, corrections, or bear markets that lasted more than a few months, then you would assume that it’s very easy to make money in the stock market.

We feel that this bias is very much running rampant in the stock market today and have positioned our clients with conservative portfolios that include 13 asset classes, and 21 different strategies across 18 different global managers.

We focus on risk adjusted returns and absolute return strategies that give us positive returns, no matter what happens in the stock market. This continues to work well for our clients.

We often joke that we serve very demanding families. When the stock market is up, they expect us to be up and when the stock market is down, they expect us to be up.

There isn’t much that keeps me up at night other than geopolitical events and what’s happening to our country. The President of the United States is having his way with the world. Recently some very positive things have happened, for example the potential of a long-term peace in the Middle East, but I do believe the negatives outweigh the positives.

Personally, we hope that the United States can come to mutually beneficial agreements with Canada and China, and that current uncertainty resolves itself. But hope is not an investment strategy. We remain focused on minimizing downside risk, building diverse portfolios that help provide our clients with a better night’s sleep.

Q3 2025 – The Markets

The third quarter of 2025 saw positive returns across most major asset classes, as markets shrugged off caution and rallied strongly.

Equity markets went into the quarter in the midst of a rebound from April’s sharp tariff-driven selloff. In the US, the S&P 500 Index returned 8.1% over the quarter (in U.S. dollar term). While there was no shortage of concerns for investors in the third quarter of 2025, equity markets benefited from optimism over a rate cut by the Fed in September (with expectations of more coming before year-end), strong corporate earnings, and renewed enthusiasm for AI, which helped boost the technology-heavy Nasdaq. Growth stocks (+8.6%) beat their value peers (+6.0%) as excitement around the tech sector ratcheted higher. Technology and communication services were strong performers, while healthcare and energy lagged, with the latter hindered by falling oil prices.

The S&P/TSX index returned 12.5% (in Canadian dollar terms) over the third quarter, benefiting from the strong rally of gold and other metals. The MSCI EAFE index (Europe, Australasia, and the Far East) returned 4.7% in US dollar terms. The MSCI Emerging Markets index returned 10.64% (in U.S. dollar), outperforming developed market stocks (7.4%), with the Chinese market leading the charge, buoyed by the extension of the US-China trade truce and AI optimism.

Bond markets were volatile throughout the quarter as global political uncertainty and concerns around fiscal sustainability came into focus.

US government bonds delivered 1.5% over the quarter, while US Treasury yields ending the quarter lower (yields are inverse to price). Short-term Treasury yields fell as market attention shifted from upside inflation risks to downside growth risks, driven by rate cut expectations and concerns about the Fed’s independence being compromised (reducing the market’s confidence in the central bank’s longer-term inflation-fighting credibility).

US headline inflation accelerated from 2.7% to 2.9% in August (year-over-year) but tariff passthrough has so far been more modest than previously feared.

The labour market in the U.S. showed clear signs of cooling. In the three months ending August 31, the US economy posted average monthly job gains of 29,000, down from 99,000 in the three months prior. The Bureau of Labour Statistics (BLS) also revised its payroll employment growth figures lower by 911,000 in the 12 months to March 2025, marking the largest such adjustment in over two decades.

Recent developments in the labor market have meaningfully shifted expectations for Federal Reserve policy. As job growth has slowed and payroll revisions have pointed to softer employment trends over the summer, investors and policymakers are reassessing the risks to the economic outlook. The Federal Reserve cut the Fed funds rate by 25 basis points in its September meeting – its first rate cut of the year – and signaled further easing ahead. Fed Chair Jerome Powell characterized the Fed’s easing in September as “risk management” to address recent weakness in the labor market, while acknowledging that inflation remains somewhat elevated. He also indicated that the Fed would remain focused on their dual mandate of stable prices and full employment, reiterating that future Fed policy would remain data dependent.

Canada’s economy shrank by 1.6% (annualized) over the second quarter because of a drop in exports. Canada’s unemployment rate rose to 7.1% in August and remained unchanged in September, its highest level since 2021. August inflation rate climbed to 1.9%, below Bank of Canada’s 2% target.

In the backdrop of labour market deterioration and economic activity weakness, Bank of Canada announced a rate cut of 25 basis points in September. The central bank said there were three determining factors in favour of a lower rate:

A weakening economy with a softening labour market, signs that pressure on core inflation could be easing, and the removal of most retaliatory tariffs by the federal government.

As we enter the last quarter of 2025, there seems to be no sign that the policy uncertainty and geopolitical risks will be abating any time soon. Earlier this year, investors held their breath as the extent of President Trump’s tariff policies were laid out. In the months that followed, investors largely ignored trade-war headlines, treating tariff threats as background noise rather than fundamental risks. The equity markets have since surged to all-time highs.

That doesn’t mean any policy effects went away. Some companies that are more vulnerable to policy changes are feeling it. Over the last several months, several bankruptcy filings in auto-parts and retail industry caught investors’ attention, including First Brands, Marelli, and Tricolor, to name a few. In the court filings, those companies cited macroeconomic headwinds associated with the imposition of tariffs have exacerbated their operational issues.

This environment reinforces the importance of our unwavering investment principles of capital preservation with thoughtful portfolio construction and proper diversification.

Q3 2025 – Charts

- The above chart shows the average year to date performance of various segments of the US stock market.

- Interestingly, companies with no revenues have recorded the highest year to date performance through September.

- This is representative of a market where future expectations are fueling a significant amount of price appreciation, which means there is increasing risk if expectations are not met or exceeded.

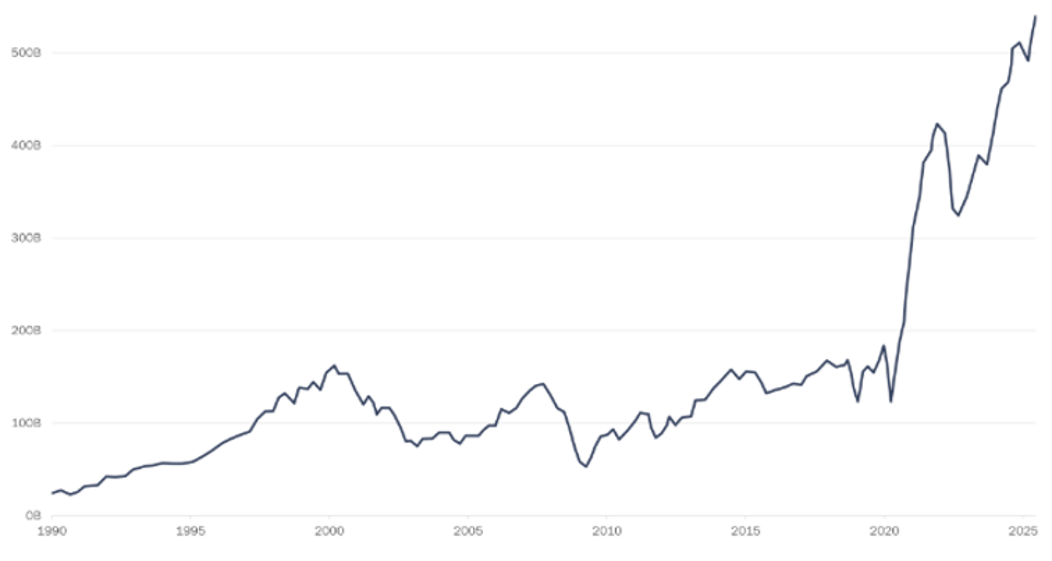

Value of U.S. Equities Held By Bottom 50% Of Household Net Worth

- The above chart shows the value of U.S. equities held by the bottom 50% of U.S. households.

- Greater retail participation in the stock market has led to an increasing amount of household net worth being tied to market performance.

- There is increasing risk that a severe market downturn wont just impact institutional or top 1% investors but also smaller investors who may not be able to withstand such a significant drawdown.

- Investor credit balances minus margin debt overlayed with S&P 500 performance over the last 30 years.

- Investors historically have negative credit balances as the market makes new highs. As markets fall there is widespread selling of securities including forced selling through margin calls, causing margin balances to turn positive.

- The Chart shows that these debt levels have peaked prior to major recessions such as the Tech Bubble (2000) and Financial Crisis (2007-2008), making it a useful indicator for future downturns.

Download a copy of this article in pdf here.

North American Wealth Award Nominations 2020:

Finalist in 3 Categories

What do I want to share with my heirs about my values and life experiences while I still can?

What do other successful families do about educating future generations?

What would happen to my family and business if I were suddenly gone tomorrow?

Is it possible that there might be other tax ideas we haven’t considered yet?

Who will make the important decisions and coordinate things after I’m gone?

Do I wonder sometimes if our planning done in the past is still relevant?

Are my investments properly compensating me for the risk I’m taking?

Which of my investments or accounts are no longer serving their intended purpose?

What do I expect market returns to look like in the next five years?

What is my Strategic Asset Allocation?