As the days become shorter and temperatures drop, investors enter the fourth quarter facing a chilly reminder that markets cannot ascend forever. Having gotten accustomed to a measured (at times, confounding) upward drift in US equities since the end of the first quarter, recent market volatility has shifted the narrative from the well-worn “cautiously optimistic” to the all too familiar yet reclusive “don’t catch a falling knife.” While the duration and magnitude of the current sell-off looms as an obvious “known unknown”, it makes sense for investors to take a step back and evaluate portfolio risk sensitivities across the asset class spectrum. With an unwavering focus on capital preservation embedded within everything we do for clients, developing insulation against a host of potential macroeconomic and market-based headwinds is a foundational principle of our investment approach.

2018’s simmering gumbo of trade war concerns, geopolitical static, rising interest rates, and currency unrest has for the most part been upstaged by healthy US corporate profit growth, tax reform, and a relatively benign inflationary environment. While difficult to pinpoint a specific catalyst behind early October’s risk-off market posture, the build-up of lingering risk factors has seemingly reached a boiling point. With no shortage of talking heads to weigh in with meticulous views on near-term market direction, a focus on fundamentals over price action has always formed the basis of our decision-making philosophy, providing a necessary dose of rationality in the face of a sharp turn in market sentiment.

Climbing from ~2.5% at the beginning of the year to ~3.2% at the time of writing, an increase in US 10-year bond yields is among the driving forces behind the recent shift in risk asset performance. At ~2.6% today, Canadian 10-year bond yields have directionally tracked the ~27% uptick our southern neighbor has experienced year to date. The multi-dimensional effects of a rise in interest rates ripples across asset classes and geographies, positively impacting some while pressuring others.

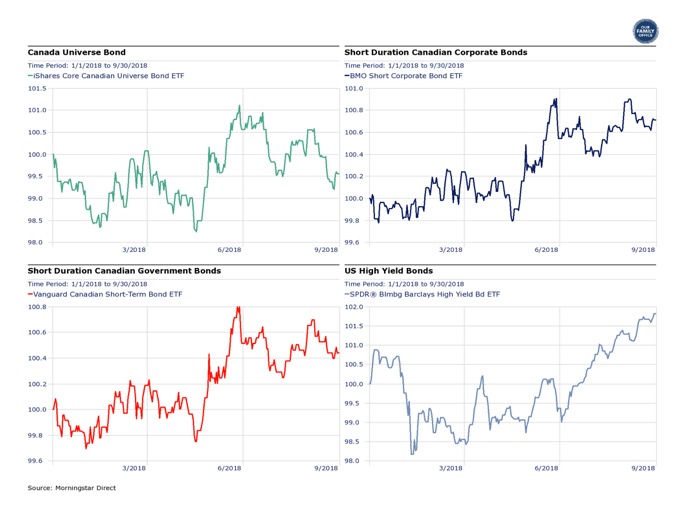

Within the fixed income space, investors are forced to grapple with an environment characterized by tight credit spreads, an aging business cycle, and the possibility of continued yield curve steepening. On the back of a 35-year decline in government bond yields, the “40” within traditional 60/40 equity/fixed income portfolios has generated an ~8% annualized return, purely on a buy and hold basis. Investors today are hard pressed to source risk adjusted return solutions anywhere close to that level in traditional fixed income markets. That said, it’s important not to lose sight of the role that high-quality bonds are intended to play within a total portfolio context, as the historical inverse correlation between duration and equity beta should remain intact going forward. By broadening the opportunity set to include a diverse array of private debt strategies, investors willing to sacrifice varying degrees of liquidity can capture attractive risk-adjusted returns alongside valuable correlation benefits, with lower sensitivity to interest rate direction or credit spread volatility.

Equity markets have benefitted handsomely from the post-crisis interest rate regime, as quantitative easing and other forms of stimulative monetary policy have supported double digit annualized returns in nearly all corners of the world since the 2009 bottom. With an artificially low risk-free rate to discount future cash flows, market participants arguably grew less discerning about quality and valuation metrics that would otherwise wield greater influence in security selection discipline. A recalibration of this relationship seems to be taking shape today, as investors begin to reprice the current value of companies’ future earnings power against a backdrop of increased cost of capital.

Though the market’s current reaction to a back-up in yields appears to take on a “sell first, ask questions later” disposition, economic winners and losers will emerge from an anticipated higher interest rate world in years to come. From an industry standpoint, most lending institutions are positioned to prosper from higher net interest margins that typically accompany a steeper yield curve. To the extent global growth continues to trend higher, consumer and industrial companies benefitting from robust demand dynamics may very well see top line expansion outpace the impact of higher operating and financing costs. On the other side of the coin, the multi-year evolution of corporate balance sheets within a low rate environment must also be factored into the equation. Record levels of BBB debt (the lowest investment grade rating), much of which has been raised to fund stock buy-backs, will eventually need to be refinanced at higher coupons. Further up the capital stack, floating rate loans, while attractive to buyers seeking an interest rate hedge, are being issued with scant covenant protection by companies with increasingly shaky leverage ratios.

By and large, businesses and securitized risk assets alike have ridden the lower interest rate wave to higher valuations over the greater part of the last decade. Stock pickers have recycled the “increased correlations” story ad nauseam to explain away underperformance in the post crisis world. While investor disappointment in the active manager community has been justifiable on balance, there is a case to be made that materially higher interest rates will drive increased dispersion within equity markets. Intuitively, it seems logical that rigorous bottom-up research will make more of a difference in separating winners from losers in an environment with less liquidity and costlier financing options. Time will tell if this theory proves correct, keeping in mind the shift in relative value perspective investors will likely assume with government bond yields outpacing stock dividends.

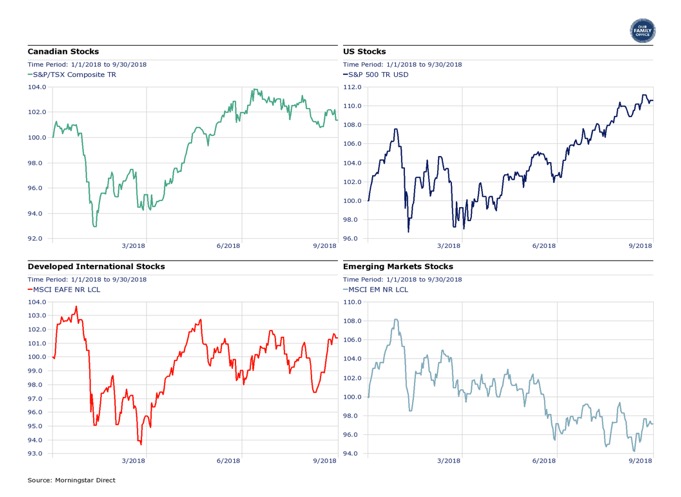

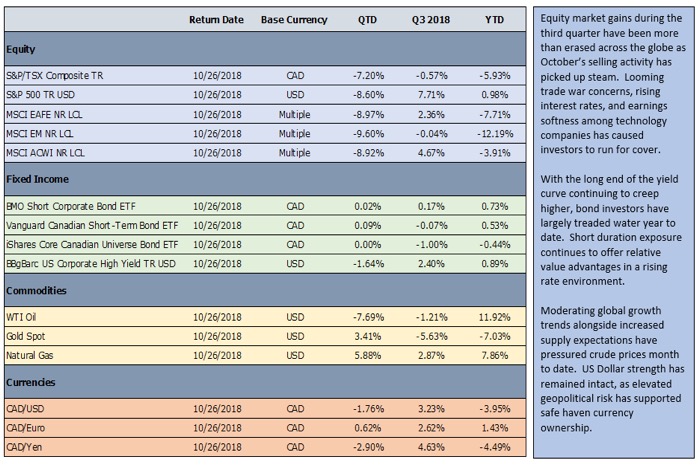

From a global growth perspective, the IMF’s recent cut from 3.9% to 3.7% for 2019 largely reflects concerns surrounding trade policy, import tariffs, and the impact of tighter financial conditions in emerging markets. The synchronized global growth narrative that dominated economic forecasts at the beginning of the year has since broken down, as the divergence between developed and emerging economies has widened. Though US equities currently represent a record 55% of global market capitalization, growth projections have been pared as escalating trade war concerns with China and waning corporate tax cuts weigh on the economic outlook. With USMCA (formerly known as NAFTA) negotiations expecting to result in a finalized deal, anxiety surrounding Canadian export constraints has subsided, supporting a stabilized 2% growth estimate for 2019. A sharp disconnect between emerging market growth rates and corresponding risk asset performance is perhaps one of the biggest surprises of 2018. Expectations for a moderating US Dollar coupled with attractive valuation levels coming into the year supported logical projections for equity upside in the emerging markets space. Rising US interest rates exacerbated by protectionist trade rhetoric invoked a US Dollar rally in early Q1, picking up steam in the spring and precipitating a sharp decline in stocks and currencies across the emerging markets sphere. While some countries have suffered more than others, widespread concern over external debt servicing capacity has kept investors at bay, even at attractive relative and absolute valuation levels.

With a high bar to meet for each dollar deployed, a decidedly selective allocation framework underpins our disciplined pursuit of exceptional long-term risk-adjusted performance. We’re happy to pass on opportunities that stretch our imagination or fail to provide the necessary downside protection consistent with the core principles of our investment philosophy. We thank you for your trust and confidence, and vow to continue to work hard to earn your business.

North American Wealth Award Nominations 2020:

Finalist in 3 Categories

What do I want to share with my heirs about my values and life experiences while I still can?

What do other successful families do about educating future generations?

What would happen to my family and business if I were suddenly gone tomorrow?

Is it possible that there might be other tax ideas we haven’t considered yet?

Who will make the important decisions and coordinate things after I’m gone?

Do I wonder sometimes if our planning done in the past is still relevant?

Are my investments properly compensating me for the risk I’m taking?

Which of my investments or accounts are no longer serving their intended purpose?

What do I expect market returns to look like in the next five years?

What is my Strategic Asset Allocation?